SoFi Investing Review: Your Ultimate Guide to Smart Investing

In today’s dynamic financial landscape, where opportunities and risks coexist, SoFi Investing emerges as a beacon for those navigating the world of online brokerage and investments. Are you curious about this platform and its potential to help you grow your wealth? If so, you’re in the right place. Join us on this SoFi Investing Review, uncovering its hidden gems and potential pitfalls, all in an effort to empower you in your quest for financial success.

Do you find yourself asking questions like, “Is SoFi Investing the right fit for me?” or “What sets it apart from the crowded field of investment platforms?” Well, you’re not alone. Our mission with this review is crystal clear: we want to equip you with the knowledge and insights you need to make confident investment decisions.

Whether you’re a complete newcomer eager to dip your toes into the world of investing or a seasoned pro seeking a fresh perspective, this review has you covered. We’ll leave no stone unturned, exploring the platform’s sign-up process, its intuitive user interface, the array of investment options at your fingertips, the financial terrain’s hidden fees, the reassuring presence of customer support, and the fortified walls of security. We aim to give you answers to your burning questions.

As we embark on this thrilling journey into the realm of SoFi Investing, we’ll make it engaging, informative, and, above all, fun. So, are you ready to unlock the secrets of SoFi Investing? Let’s dive right in and discover what this platform has in store for you!

SoFi Investing Sign-Up Process

When it comes to choosing an online investment platform, the initial sign-up process can set the tone for your entire experience. So, let’s break down the SoFi Investing sign-up journey, assessing its ease of account creation, identity verification procedures, and the array of funding options available to investors.

1. Ease of Account Creation:

SoFi Investing prides itself on simplicity, and this ethos extends to its account creation process. Whether you’re a novice or an experienced investor, getting started is a breeze. Here are the key steps:

- Basic Information: Begin by providing your essential details, such as name, email address, and phone number. This initial step is straightforward and takes only a few minutes.

- Security Measures: SoFi places a strong emphasis on security. You’ll be asked to create a secure password and verify your email address to ensure the safety of your account.

- Personal Information: Next, you’ll provide personal information like your Social Security Number (SSN), date of birth, and employment details. Rest assured, this information is required for regulatory compliance and to tailor the platform to your financial needs.

- Investment Goals: SoFi will also inquire about your investment goals and risk tolerance to recommend suitable investment options, making the process more personalized.

- Review and Confirm: Take a moment to review your information, make any necessary corrections, and confirm your account.

In summary, the account creation process is designed to be user-friendly, guiding you through each step with clarity and ease. It’s an excellent starting point for both newcomers and seasoned investors.

2. Identity Verification:

Ensuring the security and compliance of your account is paramount, and SoFi Investing implements robust identity verification measures to achieve this. The platform typically uses a combination of methods to verify your identity:

- Social Security Number (SSN): Your SSN is a crucial part of the verification process, helping confirm your identity and align your investments with tax regulations.

- Document Verification: SoFi may request additional documents such as a driver’s license or passport to validate your identity. You can usually upload these documents securely through the platform.

- Two-Factor Authentication (2FA): To further enhance security, SoFi offers 2FA, an additional layer of protection that requires you to enter a code sent to your mobile device when logging in.

While these verification steps are necessary, they contribute to a more secure investing environment, protecting both you and the platform from potential fraud.

3. Funding Options:

Once your account is set up and verified, you’re ready to fund your SoFi Investing account. The platform offers various funding options to cater to your preferences:

- Bank Transfer: You can link your bank account to transfer funds easily. This option is convenient and commonly used by investors.

- Direct Deposit: If you have a SoFi Money account, you can set up direct deposits to fund your investments seamlessly.

- Automatic Recurring Deposits: SoFi allows you to set up recurring deposits, making it effortless to invest consistently over time.

- Transfers from Other Accounts: You can transfer securities or cash from another brokerage account to your SoFi Investing account.

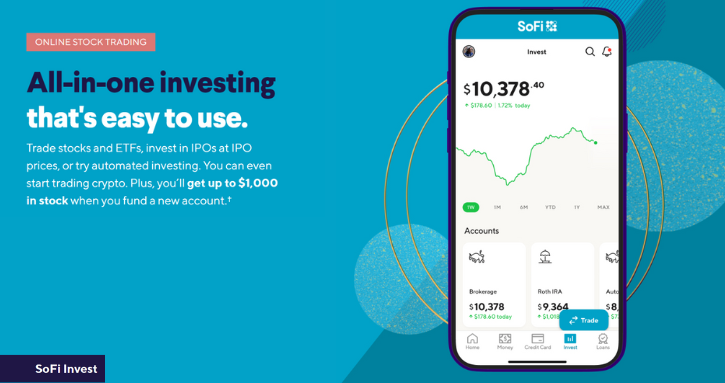

SoFi Investing Platform Interface

Are you tired of navigating convoluted investment platforms that leave you feeling lost in a sea of financial jargon? Welcome to the SoFi Investing platform, where the art of design converges with the power of investment.

As we embark on this exploration, let’s ask ourselves some vital questions: How does the design and layout of SoFi Investing impact the way we invest? What customization options are available to tailor the platform to your unique financial aspirations? And finally, in an age where your smartphone is your constant companion, how does the mobile app experience elevate your investment game? Join us as we uncover the answers and unravel the essence of SoFi Investing’s platform interface.

1. User-friendly Design and Layout:

SoFi Investing’s user interface is a testament to simplicity and clarity. Here’s what makes it stand out:

Intuitive Navigation: Upon logging in, you’re greeted with a clean and straightforward dashboard. Key sections like your portfolio, watchlist, and research tools are prominently displayed, making it easy to access essential information.

Visual Appeal: The platform employs a modern and visually appealing design, using charts, graphs, and color-coded data to help you track your investments and market trends effectively.

Educational Resources: SoFi goes the extra mile by integrating educational resources and informative articles directly into the platform, helping users make informed decisions.

Responsive Design: Whether you’re on a desktop computer or a mobile device, SoFi Investing’s interface adjusts seamlessly to your screen size, ensuring a consistent user experience.

2. Customization Options:

One size doesn’t fit all in the world of investments, and SoFi Investing acknowledges this fact by offering customization options:

Watchlists: Create and customize watchlists to track specific stocks, ETFs, or other assets of interest. This feature allows you to stay informed about your preferred investments.

Portfolio Customization: Tailor your investment portfolio to align with your risk tolerance and financial goals. SoFi provides recommendations based on your objectives, but you have the freedom to make adjustments.

Personalization: The platform adapts to your preferences over time, learning from your interactions to provide a more personalized experience.

3. Mobile App Experience:

In an era of on-the-go investing, a robust mobile app is essential. SoFi Investing’s mobile app offers a seamless and feature-rich experience:

Ease of Use: The mobile app mirrors the desktop interface’s user-friendliness, allowing you to trade, check your portfolio, and access research tools with ease.

Real-time Updates: Stay updated on market movements and your investments in real time, ensuring you never miss a crucial opportunity.

Trading on the Go: The app enables you to execute trades, set up automatic deposits, and manage your investments from anywhere, making it a valuable tool for active traders.

Security: Security features, such as biometric login options (e.g., fingerprint or face recognition), are integrated for your peace of mind.

SoFi Investing Account Types

Your financial goals, whether they involve buying your dream home, retiring comfortably, or simply growing your wealth, are as unique as you are. So, how do you navigate the investment landscape to achieve those objectives? What account types does SoFi Investing offer, and how can they be tailored to your aspirations? In this exploration, we’ll journey through the diverse world of SoFi Investing account types while addressing key questions along the way.

Here are a few questions to pique your interest:

- Are you an individual investor seeking a flexible brokerage account to build your portfolio?

- Do you want to invest collaboratively with a partner, spouse, or family member?

- Are you thinking about retirement and wondering which tax-advantaged account suits your future financial well-being – a Roth IRA or a Traditional IRA?

- Perhaps you’re a self-employed entrepreneur or a small business owner looking to secure your retirement with a SEP IRA?

- Or maybe you’re part of a small company considering options for both employer and employee retirement savings via a SIMPLE IRA?

Let’s dive into the available account types and explore the associated fees for each:

1. Individual Account:

- Description: The Individual Account is a standard brokerage account for a single investor. It allows you to buy and sell a variety of investments, such as stocks, ETFs, and cryptocurrencies.

- Fees: SoFi Investing typically charges no account management fees for Individual Accounts. However, standard trading fees may apply, such as those associated with stock and ETF trades.

2. Joint Account:

- Description: A Joint Account is designed for two or more individuals who want to invest together. It’s an ideal choice for couples, family members, or business partners looking to manage investments jointly.

- Fees: Similar to Individual Accounts, Joint Accounts generally don’t incur account management fees. Standard trading fees apply based on the investment types you trade.

3. Roth IRA (Individual Retirement Account):

- Description: A Roth IRA is a tax-advantaged retirement account that allows you to invest after-tax dollars. Contributions grow tax-free, and qualified withdrawals in retirement are tax-free as well, making it an attractive option for long-term retirement savings.

- Fees: Roth IRA accounts typically have no account management fees. However, consider that trading fees may still apply when buying and selling investments within the account.

4. Traditional IRA (Individual Retirement Account):

- Description: The Traditional IRA is another retirement account, but contributions are often tax-deductible, and earnings are tax-deferred until retirement. It’s suitable for those seeking potential tax savings now.

- Fees: Similar to Roth IRAs, Traditional IRA accounts usually don’t have account management fees. Standard trading fees may apply depending on your investment choices.

5. SEP IRA (Simplified Employee Pension Individual Retirement Account):

- Description: The SEP IRA is designed for self-employed individuals or small business owners. It offers a straightforward way to save for retirement while potentially benefiting from tax deductions.

- Fees: SEP IRA accounts generally have no account management fees. Standard trading fees apply to investments made within the account.

6. SIMPLE IRA (Savings Incentive Match Plan for Employees Individual Retirement Account):

- Description: The SIMPLE IRA is typically offered by small businesses. It provides a way for both employers and employees to contribute to retirement savings.

- Fees: As with other retirement accounts, SIMPLE IRAs usually do not incur account management fees. Standard trading fees may still apply.

It’s important to note that while SoFi Investing often does not charge account management fees for its various account types, you should carefully review the fee schedule for specific trading fees, which can vary based on the investments you choose. Additionally, consider the tax implications and contribution limits associated with retirement accounts when selecting the most suitable account type for your financial goals.

SoFi Investing Investment Options

Now, consider this: Have you contemplated the advantages of owning a piece of your favorite companies? What about the potential for growth and diversification through Exchange-Traded Funds (ETFs)? And in the age of digital revolution, have you pondered the implications of delving into cryptocurrencies like Bitcoin and Ethereum?

As we embark on this exhilarating exploration, we’ll unravel the intricate tapestry of SoFi Investing’s investment options, each thread representing a potential avenue toward your financial aspirations. Along the way, we’ll also unveil the powerful research tools and resources that empower you to navigate the labyrinth of investment decisions with confidence.

1. Types of Investments Available:

SoFi Investing opens the door to a world of possibilities. Here are the primary investment options at your disposal:

- Stocks: Invest in individual stocks of publicly traded companies. SoFi provides access to a broad range of companies across various sectors and industries.

- Exchange-Traded Funds (ETFs): ETFs offer diversification by allowing you to invest in a basket of stocks or other assets. SoFi offers a selection of ETFs covering different market segments.

- Cryptocurrencies: For the crypto enthusiasts, SoFi Investing provides a platform to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and others. It’s a convenient way to enter the world of digital assets.

- Automated Investing (Robo-Advisory): SoFi offers automated investing options where your portfolio is managed by algorithms based on your risk tolerance and financial goals. This is an excellent choice for hands-off investors.

2. Investment Research Tools and Resources:

Arming investors with the right information is key to making informed decisions. SoFi Investing empowers you with a suite of research tools and resources:

- Educational Content: Access to articles, videos, and webinars covering a wide range of investment topics. Whether you’re a beginner or a seasoned investor, there’s something for everyone.

- Real-time Market Data: Stay up-to-date with real-time market data, including stock prices, performance metrics, and news.

- Stock and ETF Screeners: Use customizable screeners to filter and identify investment opportunities that match your criteria.

- Financial News and Analysis: Stay informed about market trends and developments with access to financial news and analysis from reputable sources.

- Portfolio Tracking: Monitor the performance of your investments in real time and gain insights into your portfolio’s asset allocation.

- Investment Recommendations: SoFi offers investment recommendations tailored to your risk tolerance and financial goals. These recommendations can guide your investment choices.

SoFi Trading Features

Have you ever wondered what it takes to become a savvy trader in today’s fast-paced markets? SoFi Investing isn’t just a platform; it’s your gateway to a world of trading possibilities.

Consider this: How can various order types help you execute trades with precision? Are you making the most of extended trading hours? And in a world where speed matters, how reliable is your trading platform?

In this exploration, we’ll delve into the order types available, trading hours, and the platform’s execution speed and reliability.

1. Order Types:

SoFi Investing provides a variety of order types, allowing you to execute trades according to your specific strategies and preferences:

Market Orders: This order type executes at the current market price, providing speed and certainty of execution. It’s ideal when you want to buy or sell quickly.

Limit Orders: With limit orders, you specify the exact price at which you’re willing to buy or sell an asset. The order will only execute when the market reaches your specified price.

Stop Orders: Stop orders are used to limit potential losses or secure gains. A stop order becomes a market order when the asset’s price reaches a certain level, helping you control your exit strategy.

Trailing Stop Orders: These orders automatically adjust the stop price as the market price moves in your favor. They are effective for locking in profits while allowing room for further gains.

Stop-Limit Orders: This order type combines elements of both stop and limit orders. It triggers a limit order when the stop price is reached, providing more control over execution.

2. Trading Hours:

SoFi Investing aligns with standard market trading hours, but it also caters to extended hours trading:

Standard Trading Hours: You can trade during the standard market hours, typically from 9:30 AM to 4:00 PM Eastern Time (ET) on regular trading days.

Extended Hours Trading: SoFi Investing offers extended trading hours before the market opens and after it closes. Pre-market and after-hours trading can provide opportunities for investors who want to react to news and events outside of regular hours.

3. Execution Speed and Reliability:

When it comes to executing trades, speed and reliability are paramount. SoFi Investing strives to provide:

Fast Execution: The platform aims for swift order execution to minimize the impact of price fluctuations on your trades.

Reliability: SoFi Investing invests in robust infrastructure to ensure platform stability and uptime, reducing the risk of interruptions during trading sessions.

Real-time Updates: Stay informed with real-time updates on your orders and positions, enabling you to react quickly to changing market conditions.

Order Confirmation: Receive immediate confirmation of executed orders, enhancing transparency in your trading activities.

SoFi Pricing and Fees

Imagine having a financial ally that not only provides you with a clear fee structure but also empowers you to make informed decisions about your investments. Welcome to SoFi Investing, where transparency meets financial wisdom.

1. Commission Structure:

One of the standout features of SoFi Investing is its commitment to commission-free trading. That’s right – when you buy and sell stocks, ETFs, or cryptocurrencies on the platform, you generally won’t incur any commission fees. This fee structure can be especially appealing to both new and experienced investors, as it allows you to focus on your investments without worrying about transaction costs.

2. Additional Fees:

While SoFi Investing boasts commission-free trading, it’s important to be aware of potential additional fees that may apply:

- Account Transfer Fees: If you’re transferring your investments from another brokerage to SoFi, the outgoing brokerage may charge transfer fees. However, SoFi itself typically does not charge fees for incoming transfers.

- Account Maintenance Fees: SoFi Investing typically does not charge account maintenance fees, which can be a relief for long-term investors.

3. Fee Comparison with Competitors:

When evaluating the cost of investing with SoFi, it’s helpful to compare its fee structure to that of its competitors. Many traditional brokerages and online platforms charge commission fees that can range from $4.95 to $7.00 or more for each trade. Over time, these commissions can add up significantly. SoFi’s commission-free approach can be a significant cost-saving advantage, especially for active traders.

However, it’s essential to consider other factors beyond just fees when comparing investment platforms. Consider factors such as the range of available investment options, research tools, customer support, and the overall user experience. Your choice should align with your investment style and goals.

SoFi Investment Performance

Investing is not just about making choices; it’s about making wise and well-thought choices that lead to financial growth. SoFi Investing recognizes this and equips you with a suite of tools and features to help you track performance, analyze your portfolio, and optimize your taxes. Let’s get into these critical aspects of SoFi Investment Performance:

1. Performance Tracking Tools:

Keeping a close eye on your investments is fundamental to success. SoFi Investing provides you with performance tracking tools that allow you to monitor your investments’ progress in real time. These tools typically include:

- Interactive Charts: Visualize your investment performance over time with interactive charts. Track the highs and lows, compare your investments to market benchmarks, and gain insights into trends.

- Performance Metrics: Access key performance metrics such as returns on your investments, dividend yields, and more, helping you assess how your portfolio is performing.

- Real-time Updates: Stay informed with real-time updates on your investments. Receive notifications about price changes, news, and events that may impact your holdings.

2. Portfolio Analysis and Reporting:

Effective portfolio management requires a deep understanding of your investments. SoFi Investing offers portfolio analysis and reporting tools to help you make data-driven decisions:

- Portfolio Diversification: Assess the diversification of your portfolio to ensure you’re not overly exposed to a single asset or sector. Diversification can help manage risk.

- Asset Allocation: Analyze your asset allocation to see if it aligns with your investment goals and risk tolerance. Adjusting your allocation can be essential for achieving your financial objectives.

- Tax Efficiency: Understand the tax implications of your investments. SoFi’s tools may help you identify tax-saving opportunities, such as tax-loss harvesting.

3. Tax Optimization Features:

Taxes can significantly impact your investment returns. SoFi Investing aims to optimize your tax situation through features like:

- Tax-Loss Harvesting: This strategy involves selling investments at a loss to offset capital gains, potentially reducing your tax liability.

- Tax-Efficient Funds: SoFi may offer tax-efficient investment options designed to minimize the tax consequences of your investments.

- Roth and Traditional IRAs: SoFi provides these tax-advantaged account options, allowing you to choose the most tax-efficient retirement savings vehicle based on your circumstances.

SoFi Investing helps you maximize your financial potential while ensuring that your investments align with your goals and tax strategies. Whether you’re aiming for short-term gains or long-term growth, SoFi Investing equips you with the tools to make your financial journey a successful one.

SoFi Customer Support

Navigating the complexities of the financial world can sometimes be daunting. That’s where SoFi’s commitment to exceptional customer support comes into play. In this exploration, we’ll delve into the availability, responsiveness, and helpfulness of SoFi’s customer support, along with insights into user experiences.

1. Availability (Phone, Email, Chat):

SoFi understands that accessibility is key to providing top-notch customer support. They offer multiple channels for you to reach out:

- Phone: You can typically connect with a SoFi representative via phone during business hours. This direct communication channel allows for real-time assistance and is valuable for urgent queries.

- Email: If you prefer written communication, SoFi’s customer support team is usually accessible through email. You can send detailed inquiries or requests, and you’ll receive responses within a reasonable timeframe.

- Chat: Live chat is often available on the SoFi website and mobile app. This option offers immediate assistance and is ideal for quick questions or clarifications.

2. Responsiveness and Helpfulness:

Prompt and helpful responses are at the core of a positive customer support experience. SoFi strives to excel in this aspect:

- Responsiveness: SoFi aims to provide timely responses to inquiries, whether through phone, email, or chat. They recognize the importance of addressing customer needs promptly.

- Helpfulness: Customer support representatives are typically well-trained and knowledgeable. They can assist with a wide range of queries, from account-related issues to investment guidance and technical support.

3. User Experiences with Customer Support:

User experiences can provide valuable insights into the quality of customer support. While individual experiences can vary, many SoFi users have reported positive interactions with SoFi’s support team. They have praised the platform’s commitment to assisting users in a friendly and informative manner.

Additionally, SoFi has received recognition for its dedication to customer satisfaction and its efforts to continuously improve the customer support experience.

SoFi Security and Regulation

Picture this: You’re about to embark on a financial journey, and your priority is to ensure that your investments and personal information are shielded from potential threats. That’s where SoFi steps in, not just as a financial platform but as your vigilant guardian.

Security and compliance are paramount in the world of finance, and SoFi takes both seriously to ensure the safety of your investments and sensitive information. In this discussion, we’ll explore the security measures implemented by SoFi, its commitment to regulatory compliance, and the insurance coverage provided for your investments.

1. Security Measures (Encryption, Two-Factor Authentication):

SoFi prioritizes the protection of your financial data and personal information through robust security measures:

- Encryption: SoFi employs state-of-the-art encryption protocols to safeguard data transmission and storage. This encryption helps protect your information from unauthorized access.

- Two-Factor Authentication (2FA): To enhance account security, SoFi typically offers the option of 2FA. This additional layer of protection requires you to provide two forms of authentication (usually something you know, like a password, and something you have, like a mobile device) to access your account.

- Biometric Authentication: Some SoFi services may also incorporate biometric authentication methods like fingerprint or facial recognition, adding an extra level of security to your account.

2. Regulatory Compliance:

SoFi operates in accordance with industry regulations and strives to maintain a high level of transparency and compliance:

- Registered Broker-Dealer: SoFi Securities LLC, a subsidiary of SoFi, is registered with the U.S. Securities and Exchange Commission (SEC) as a broker-dealer, ensuring compliance with federal securities laws.

- Member of FINRA and SIPC: SoFi Securities is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). SIPC provides protection up to certain limits against the loss of cash and securities held by a customer in the event of a broker-dealer’s financial failure.

3. Insurance Coverage for Investments:

SoFi Investing typically provides insurance coverage to further protect your investments:

- SIPC Insurance: As a member of SIPC, SoFi Investing offers coverage up to $500,000 for securities, including $250,000 for cash, per account type in the event of a brokerage firm’s insolvency.

- Additional Private Insurance: SoFi may also have additional private insurance coverage to protect your investments beyond the limits provided by SIPC.

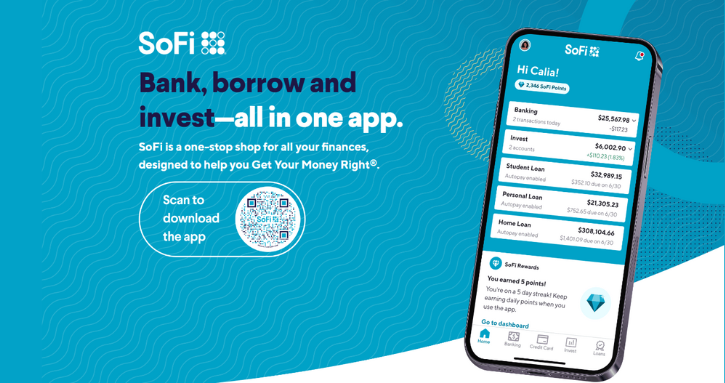

SoFi Mobile App

Whether you’re in the office, on the move, or just relaxing at home, SoFi’s robust mobile app is your constant companion, ready to transform your smartphone into a financial superpower.

SoFi recognizes this need and offers a robust mobile app designed to empower you with financial management at your fingertips. Let’s explore the features available on the SoFi mobile app and provide insights into the user experience and ratings.

1. Features Available on the Mobile App:

The SoFi mobile app provides a comprehensive suite of features to help you manage your finances, invest, and make informed decisions:

- Account Access: View your investment accounts, check balances, and track your portfolio’s performance in real time.

- Trading: Buy and sell stocks, ETFs, and cryptocurrencies with ease directly from your mobile device.

- Mobile Deposit: Fund your SoFi account by taking photos of checks, eliminating the need for physical deposits.

- Financial Planning: Access financial planning tools and resources to help you set and track your financial goals.

- Portfolio Analysis: Analyze your portfolio’s diversification and performance, helping you make data-driven investment decisions.

- Educational Content: Access a wealth of articles, videos, and webinars to enhance your financial literacy.

- Security Features: Utilize biometric authentication, such as fingerprint or facial recognition, to enhance the security of your mobile app.

2. User Experience and Ratings:

User experiences and ratings play a vital role in evaluating the quality of a mobile app. While individual experiences may vary, SoFi’s mobile app generally receives positive feedback:

- User-Friendly: Many users find the app easy to navigate, with an intuitive interface that simplifies the investing and financial management process.

- Performance: The app is often praised for its fast and responsive performance, ensuring that you can access your accounts and make trades without delays.

- Ratings: SoFi’s mobile app typically garners high ratings on app stores, with users appreciating its functionality and user-friendly design.

- Regular Updates: SoFi consistently updates its app to add new features and improve the user experience, which contributes to its positive reputation.

SoFi Pros

SoFi Investing offers a range of advantages and strengths that appeal to a diverse array of investors. Here are some of the key pros of SoFi Investing:

1. Commission-Free Trading: SoFi Investing prides itself on commission-free trading, allowing investors to buy and sell stocks, ETFs, and cryptocurrencies without incurring transaction fees. This fee structure can result in significant cost savings over time.

2. Diverse Investment Options: SoFi provides access to a broad range of investment options, including stocks, ETFs, and cryptocurrencies like Bitcoin and Ethereum. This diversity allows investors to create well-rounded portfolios tailored to their financial goals.

3. Robust Educational Resources: SoFi Investing offers a wealth of educational content, including articles, videos, and webinars, to help users enhance their financial literacy and make informed investment decisions.

4. User-Friendly Mobile App: The SoFi mobile app is praised for its intuitive design and ease of use. It provides a seamless experience for managing investments on the go, with features like portfolio tracking and trading capabilities.

5. Accessible Customer Support: SoFi typically provides accessible customer support through various channels, including phone, email, and chat. This support network can be valuable for addressing inquiries and resolving issues.

6. Financial Planning Tools: SoFi offers financial planning tools to help users set and track their financial goals, providing valuable guidance on their investment journey.

7. Competitive Rates for Loans and Mortgages: Beyond investing, SoFi offers competitive rates on personal loans, student loan refinancing, and mortgages, allowing users to manage their overall financial well-being.

SoFi Cons

While SoFi Investing offers numerous advantages, it’s essential to consider some potential disadvantages and areas for improvement:

1. Limited Investment Research Tools: Some users may find the investment research tools on SoFi Investing to be less extensive compared to dedicated research platforms. Advanced investors may desire more in-depth data and analysis.

2. Limited Asset Types: While SoFi offers a variety of investment options, it may not cater to investors seeking highly specialized or niche assets. Investors with specific asset preferences might need to look elsewhere.

3. Inactivity Fee: SoFi may charge an inactivity fee if there is no trading or account activity for a specified period. Users should be aware of this fee, especially if they maintain accounts with minimal activity.

4. Limited International Access: SoFi Investing may have limited access for international investors or those residing outside the United States. Availability can vary by location.

5. Variable Customer Experiences: User experiences with customer support can vary. While many users have positive interactions, there may be occasional reports of less satisfactory support experiences.

Final Thoughts on SoFi Investing

SoFi Investing emerges as a robust and user-friendly investment platform, particularly suited for investors seeking commission-free trading and a diverse array of investment options. Its mobile app simplifies on-the-go portfolio management, and its educational resources can empower users to make financial decisions well.

While SoFi Investing offers numerous advantages, it’s essential to consider potential limitations, such as the scope of research tools and asset types, as well as associated fees. Users with specific investment preferences or advanced research needs may wish to supplement their use of SoFi with additional tools or platforms.

Overall, SoFi Investing can be a valuable choice for investors looking for a user-friendly and cost-effective platform to manage their investments. It’s particularly well-suited for those who value educational resources and accessibility. However, as with any investment platform, it’s crucial to align your choice with your unique financial goals and preferences.